Introduction

Building a personal budget can feel overwhelming, especially if you’ve never tracked your income and expenses before. The good news? You don’t need to give up your favorite activities or lifestyle to gain control over your finances. With the right approach, a personal budget can help you save more, reduce stress, and even invest in things that matter most to you.

1. Understand Your Income and Expenses

1. Understand Your Income and Expenses

Before creating a budget, you need to know how much money is coming in and where it’s going.

Steps:

-

List all sources of income (salary, freelance work, dividends, etc.)

-

Track your spending for at least one month (use apps like Mint, YNAB, or PocketGuard)

-

Categorize expenses into essentials (rent, utilities, groceries) and non-essentials (dining out, entertainment, subscriptions)

Pro tip: Using budgeting apps can automate tracking and provide insights on spending patterns.

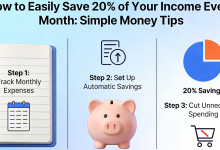

2. Set Realistic Savings Goals

A budget isn’t just about restricting yourself—it’s about planning. Decide how much you want to save each month without compromising your lifestyle.

Steps:

-

Determine a realistic percentage of income to save (10–20% is a common starting point)

-

Break it down into short-term (emergency fund, vacation) and long-term goals (retirement, investment)

-

Automate savings through direct deposits into a separate account

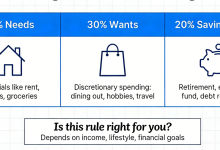

3. Choose a Budgeting Method That Fits You

Not all budgets are the same. Pick one that matches your personality and lifestyle:

-

50/30/20 Rule

-

50% for needs

-

30% for wants

-

20% for savings

-

-

Zero-Based Budgeting

-

Every dollar is assigned a purpose

-

Great for precise control over spending

-

-

Envelope System (physical or digital)

-

Allocate cash for different categories

-

Helps prevent overspending

-

4. Track Your Spending Consistently

A budget is only useful if you follow it. Tracking spending keeps you aware and accountable.

Tips:

-

Review your expenses weekly

-

Adjust categories if needed

-

Use apps or spreadsheets for easy tracking

-

Take note of recurring subscription costs and evaluate necessity

5. Cut Costs Without Sacrificing Lifestyle

Cutting costs doesn’t mean cutting fun. The key is smart spending:

-

Switch to cost-effective alternatives for daily expenses

-

Use cashback apps and credit card rewards

-

Plan meals to reduce food waste and dining out expenses

-

Consider bundling subscriptions or eliminating unused services

Pro tip: Look for tools like Honey, Rakuten, or bank apps that automate savings or cashback.

6. Plan for Irregular Expenses

Many people fail to budget for irregular costs like annual insurance, holiday gifts, or car maintenance.

Steps:

-

Make a separate category for irregular expenses

-

Divide the total annual cost by 12 and set aside monthly

-

Use a high-yield savings account for these funds

7. Review and Adjust Monthly

A budget is not static—it should evolve with your income, lifestyle, and goals.

-

Review performance at the end of each month

-

Celebrate savings milestones

-

Adjust spending categories based on changing priorities

8. Leverage Financial Tools

Financial tools can make budgeting easier, faster, and smarter:

-

Budgeting Apps: Mint, YNAB, PocketGuard

-

Spreadsheets: Google Sheets or Excel templates

-

Bank Tools: Automatic transfers, alerts, and round-up savings

Conclusion

Creating a personal budget from scratch doesn’t require sacrificing your lifestyle. By understanding your income, setting realistic savings goals, choosing the right budgeting method, tracking spending, cutting costs smartly, planning for irregular expenses, and leveraging financial tools, you can take control of your finances and save more while still enjoying life.

Better Finance Info – Personal Finance & Investing Tips

Better Finance Info – Personal Finance & Investing Tips