Saving 20% of your income may sound unrealistic, but with the right strategy, it’s absolutely achievable—even on an average salary. The key is not earning more, but managing your money smarter.

Saving 20% of your income may sound unrealistic, but with the right strategy, it’s absolutely achievable—even on an average salary. The key is not earning more, but managing your money smarter.

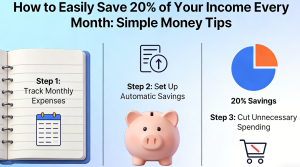

1. Pay Yourself First

Before paying bills or spending on non-essentials, automatically transfer 20% of your income into a savings account. Treat savings like a fixed expense, not an afterthought.

2. Track Every Expense

You can’t save what you don’t measure. Use a budgeting app or spreadsheet to track where your money goes each month. Small, unnoticed expenses often add up to hundreds of dollars.

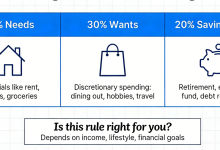

3. Use the 50/30/20 Rule

A simple framework:

-

50% for needs (rent, food, utilities)

-

30% for wants (entertainment, dining out)

-

20% for savings and investments

Adjust the percentages if needed, but always protect your savings portion.

4. Cut High-Impact Expenses

Instead of cutting everything, focus on big expenses:

-

Housing

-

Transportation

-

Subscriptions

Negotiating bills or switching providers can instantly free up money for savings.

5. Increase Savings with Every Raise

Whenever you get a raise or bonus, increase your savings rate before lifestyle inflation kicks in.

Final Thoughts

Saving 20% consistently builds financial security, reduces stress, and accelerates wealth growth. Start small if needed, but stay consistent.

Article 2

How to Build a Personal Budget from Scratch Without Sacrificing Your Lifestyle

Many people avoid budgeting because they think it means giving up everything they enjoy. In reality, a good budget gives you freedom—not restriction.

1. Know Your Monthly Income

Start with your net income (after taxes). Use a realistic average if your income varies.

2. List Fixed and Variable Expenses

-

Fixed expenses: rent, insurance, subscriptions

-

Variable expenses: food, entertainment, shopping

This helps you identify areas where adjustments are easier.

3. Set Realistic Spending Limits

A budget only works if it fits your life. Don’t eliminate fun—control it. Allocate money for things you enjoy, guilt-free.

4. Create Saving Categories

Instead of one generic savings account, divide savings into:

-

Emergency fund

-

Short-term goals (travel, gadgets)

-

Long-term goals (investing, retirement)

This makes saving more motivating.

5. Review and Adjust Monthly

Life changes—and your budget should too. Review it monthly and adjust based on your actual spending.

Final Thoughts

Budgeting isn’t about restriction—it’s about awareness and control. When your money has a plan, you stay in control instead of wondering where it went.

Better Finance Info – Personal Finance & Investing Tips

Better Finance Info – Personal Finance & Investing Tips