Creating a budget is one of the most important steps toward achieving financial stability. However, many people struggle to find a system that is simple, effective, and flexible enough to fit their lifestyle.

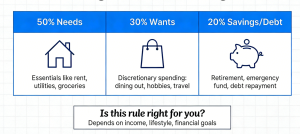

The 50/30/20 rule has gained popularity because it provides a straightforward framework for dividing your income: 50% for needs, 30% for wants, and 20% for savings or debt repayment. But is it really the best approach for everyone? In this article, we’ll break down the 50/30/20 rule, explore its pros and cons, and show you how to implement it successfully.

1. What Is the 50/30/20 Rule?

The 50/30/20 rule is a simple budgeting method introduced by Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan.

The basic formula:

-

50% Needs: Essentials you must pay for each month, like rent, utilities, groceries, transportation, insurance.

-

30% Wants: Non-essential spending that enhances your lifestyle, such as dining out, entertainment, vacations, hobbies, and subscriptions.

-

20% Savings & Debt Repayment: Includes emergency funds, retirement accounts, investment contributions, and paying down debt.

The 50/30/20 rule works because it is flexible enough for beginners while providing clear limits to prevent overspending.

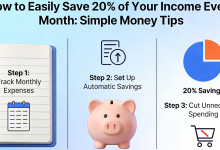

2. How to Calculate Your 50/30/20 Budget

To start, you’ll need to know your after-tax income, also called net income. Here’s a step-by-step guide:

-

Determine your net income – Include all income sources: salary, freelance work, dividends, etc.

-

Divide your income into categories

-

Needs = 50% of net income

-

Wants = 30% of net income

-

Savings & Debt = 20% of net income

-

Example:

If your monthly net income is $4,000:

-

Needs: $2,000

-

Wants: $1,200

-

Savings & Debt: $800

3. Examples of Needs, Wants, and Savings

Needs (50%)

-

Rent or mortgage

-

Utilities (electricity, water, internet)

-

Groceries

-

Transportation (fuel, public transit, car payment)

-

Insurance (health, auto, home)

Wants (30%)

-

Dining out or coffee shops

-

Streaming services & subscriptions

-

Travel & vacations

-

Hobbies & entertainment

-

Shopping for non-essential items

Savings & Debt Repayment (20%)

-

Emergency fund contributions

-

Retirement savings (401k, IRA)

-

Investment accounts

-

Paying off credit cards or student loans

4. Benefits of the 50/30/20 Rule

-

Simplicity: Easy to understand and apply for beginners.

-

Flexibility: Can be adapted based on income, lifestyle, or financial goals.

-

Encourages Savings: Ensures at least 20% of income goes to savings or debt repayment.

-

Promotes Balance: Allocates money for both essentials and lifestyle enjoyment.

5. Potential Drawbacks

While the 50/30/20 rule is helpful, it may not suit everyone:

-

High Cost of Living: In expensive cities, needs may exceed 50% of income.

-

Debt Challenges: If debt is high, allocating only 20% for repayment might be insufficient.

-

Individual Goals: Aggressive savings goals or early retirement plans may require adjusting percentages.

-

Irregular Income: Freelancers or commission-based workers may need a more flexible approach.

6. How to Adjust the 50/30/20 Rule for Your Life

Tips for customization:

-

High Living Costs: Reduce wants to 20% and increase needs to 60% if necessary.

-

Aggressive Saving Goals: Adjust savings to 30–40% by cutting wants.

-

Irregular Income: Calculate your average monthly income over 3–6 months, then apply the rule.

-

Debt Prioritization: Allocate more than 20% to pay off high-interest debt faster.

7. Tools to Help You Follow the 50/30/20 Rule

Budgeting apps and tools make following this rule easier and more accurate:

-

YNAB (You Need a Budget): Focuses on assigning every dollar a purpose.

-

Mint: Tracks expenses automatically and categorizes spending.

-

EveryDollar: Simple app for zero-based budgeting that can accommodate 50/30/20.

-

Spreadsheets: Google Sheets or Excel templates for DIY tracking.

You can link to these apps in your article to monetize through affiliate programs.

8. Real-Life Examples

Case Study 1: Emily, 28, Marketing Specialist

-

Net income: $3,500/month

-

Needs: $1,750 (rent, utilities, groceries, insurance)

-

Wants: $1,050 (dining out, travel, hobbies)

-

Savings: $700 (emergency fund, IRA)

Case Study 2: Jason, 35, Freelancer

-

Income varies $2,500–$4,500

-

Uses average monthly income $3,500

-

Needs: $1,750

-

Wants: $1,050

-

Savings: $700, supplemented during high-income months

9. Tips for Sticking to Your 50/30/20 Budget

-

Automate Savings: Set up automatic transfers to savings accounts.

-

Track Regularly: Review weekly or bi-weekly spending.

-

Cut Unnecessary Expenses: Cancel unused subscriptions, meal prep, shop smart.

-

Adjust When Needed: Life changes, adjust percentages but maintain balance.

-

Reward Yourself: Allocate some “fun money” to stay motivated.

10. Conclusion

The 50/30/20 rule is a simple and effective framework for managing your money. While it may not be perfect for every individual, it provides a balanced approach to cover essentials, enjoy lifestyle perks, and save for the future. By customizing it to your income, goals, and personal circumstances, you can build a sustainable budgeting system that supports both financial security and life enjoyment.

Better Finance Info – Personal Finance & Investing Tips

Better Finance Info – Personal Finance & Investing Tips