About Trust & Will

Estate planning can often be complicated and expensive, but Trust & Will offers a more affordable approach. You can create a will starting at $199 or a trust for $499. While the company is not a law firm, it uses an in-house team of advisors to help generate documents through a user-friendly online platform. The company suggests that a complete, personalized estate plan can be ready in about 15 minutes, though we recommend reviewing the legal guidance carefully to ensure the plan meets your family’s needs.

Estate planning can often be complicated and expensive, but Trust & Will offers a more affordable approach. You can create a will starting at $199 or a trust for $499. While the company is not a law firm, it uses an in-house team of advisors to help generate documents through a user-friendly online platform. The company suggests that a complete, personalized estate plan can be ready in about 15 minutes, though we recommend reviewing the legal guidance carefully to ensure the plan meets your family’s needs.

As the name implies, Trust & Will allows you to quickly create wills, trusts, and guardianship documents at reasonable rates. If you prefer to skip the traditional attorney route, the platform provides customized, state-specific legal documents to help you plan your estate effectively.

While there are many other companies offering online will and trust services, Trust & Will stands out for its speed and clarity. The website clearly lays out its services and pricing and includes a comprehensive learning center for those who want to understand more about estate planning. The platform works particularly well for simple estates, allowing you to either download your documents or request printed copies shipped to you within minutes.

The company also uses strong data encryption to protect your information. Although Trust & Will does not provide phone support, its live chat feature proved to be responsive and helpful during testing.

Pros

-

Offers both individual and couple plans

-

Unlimited updates during the first year

-

Efficient method for creating legally binding documents for straightforward estates

-

Provides step-by-step guidance and answers to common questions

Cons

-

Attorney support is not available in every state

-

Requires an annual fee after the first year to continue updating documents

Trust & Will Features and Benefits

In addition to the essential estate planning documents, a Trust & Will membership offers several added benefits:

Document Sharing: You can easily share your estate planning documents with family members, financial advisors, or other professionals, giving them secure virtual access to your plan.

Customer Support: While Trust & Will does not provide phone support, you can get timely assistance via email and a responsive live chat feature. For those who prefer phone or in-person support, the company offers an optional Attorney Support service.

Account Security: All documents on the platform are fully encrypted, ensuring your personal information remains protected. Trust & Will also guarantees that your information will never be sold.

Attorney Review: You have the option to receive personalized legal guidance from an attorney licensed in your state, giving you added peace of mind.

Our Experience Using Trust & Will

We at Retirement Living tried Trust & Will’s will creation service and were able to generate a personalized will in roughly 30 minutes. To make the process smoother and faster, it’s helpful to have all necessary information on hand, including details about assets such as real estate, bank accounts, vehicles, and business holdings. With this information ready, the platform allows you to complete a comprehensive estate plan efficiently.

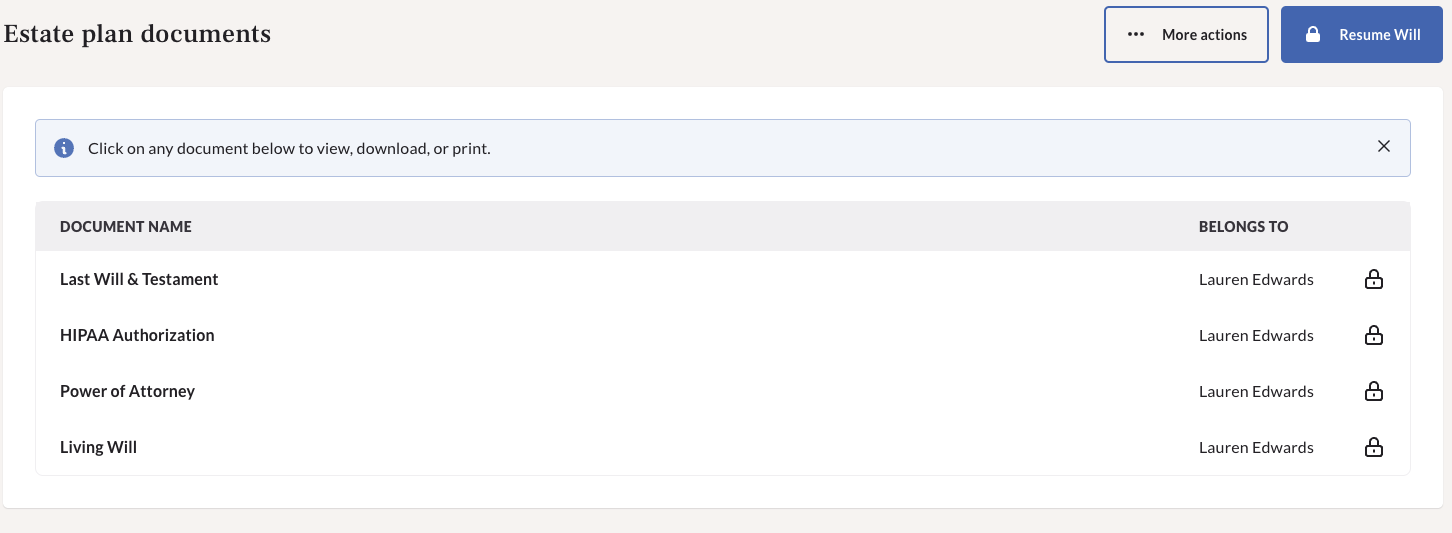

After creating an account and paying for a service, you’ll have access to a dashboard with Trust & Will that will house all your estate planning documents. You can also add a legacy contact, which is a person you designate to have read-only access to your dashboard.

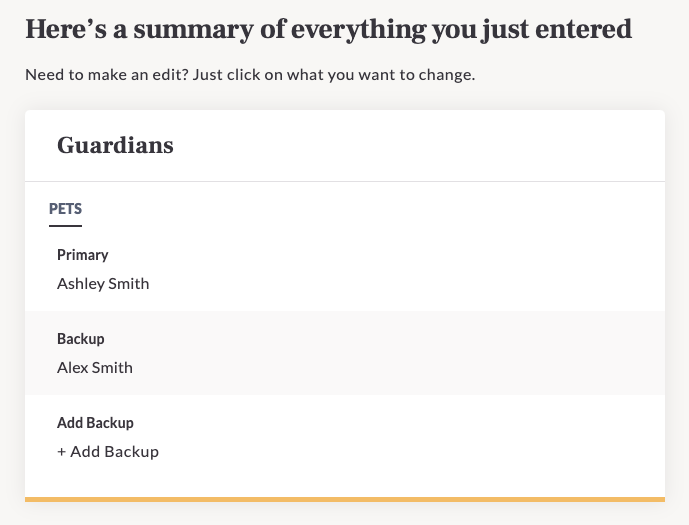

Here’s the process we followed for making a will with Trust & Will:

- Fill out your basic information (i.e., marital status, whether you have children, your state, etc.).

- Name guardians for your children and your pets, if applicable.

- Name beneficiaries and name specific exclusions for recipients, if applicable.

- Appoint an executor and an optional backup executor. You can also appoint a digital executor for social media accounts, emails, or cryptocurrency accounts.

- Allocate gifts and charity donations as they pertain to your property, financial accounts, life insurance, and more.

Navigating Trust & Wills’ online creator is easy—regardless of your technical prowess. The online creator has a user-friendly design with simple form-fill questions to complete your documents. Similar to a tax software program, you simply answer the questions and input information to generate your paperwork. The platform will show you summaries of your information at various stages of the process, as seen below.

Track your progress and edit information as needed using the guided questionnaire and builder.

Track your progress and edit information as needed using the guided questionnaire and builder.Then, download your documents or have them mailed to you for free. You’ll need to legalize your will according to your state’s requirements — in many cases, this will require signing your documents alongside two witnesses.

Your documents and dashboard are state-specific, which helps ensure you create legally-binding documents. Our tester was located in North Carolina, so our dashboard also included insights on North Carolina estate and inheritance tax, in addition to instructions for making our will legal.

Policy for Updating Your Trusts & Wills

When selecting a service to help plan your estate, you should look for companies that allow revisions and edits as your needs change. Trust & Will offers an unlimited amount of free updates for a year. Simply access your saved files on the platform and update them as needed.

Beyond the first year, you’ll pay a smaller fee to continue your membership and edit your documents.

Trust & Will vs. Using an Attorney

Though Trust & Will enlists attorneys to help build their legal documents, the company is not a law firm. This means you should consult a lawyer or financial advisor on estate planning steps that are specific to your needs. Trust & Will allows you to share files or loop in your advisor as needed. It’s important to know that its documents are built using standard language to accommodate a wide range of customer scenarios, save for certain customization features.

Many customers praise Trust & Will for its affordability and access to a comprehensive portfolio of estate planning forms. These are especially useful if you need to create a standard trust or will without paying high attorney fees.

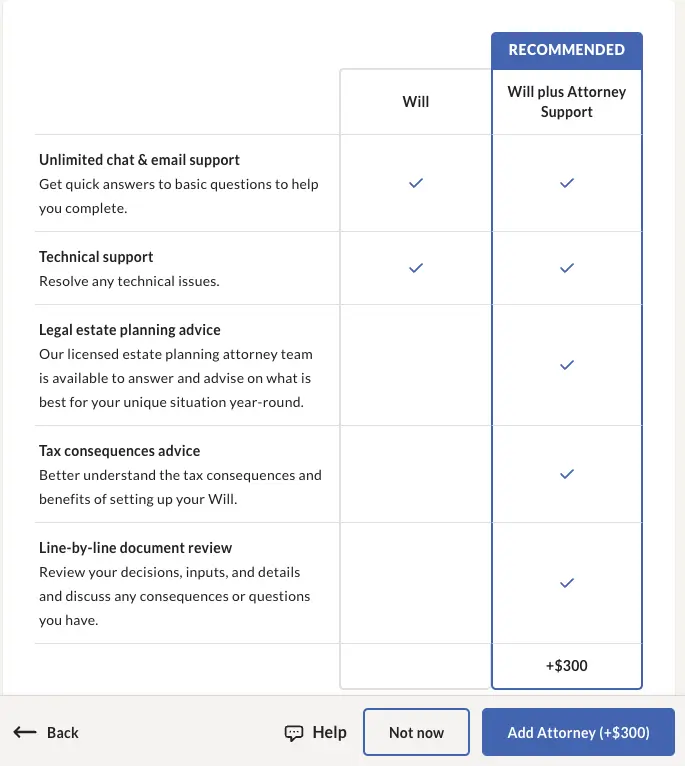

If you’d prefer extra peace of mind, Trust & Will offers one year of unlimited support from a licensed attorney who will review your documents line-by-line and offer input. This service costs $300.

Trust & Will offers support from an attorney.

Trust & Will offers support from an attorney.Trust & Will Costs and Membership Benefits

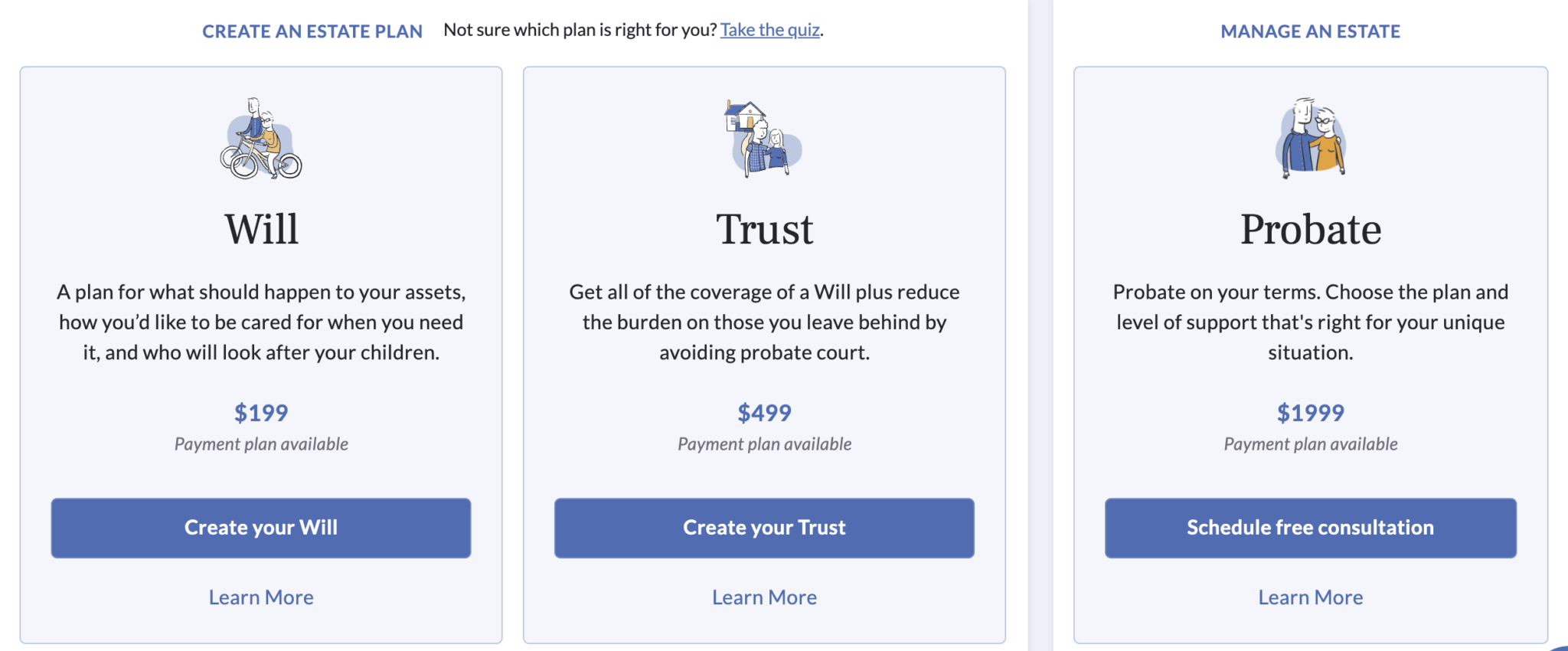

Trust & Will offers flexible pricing plans tailored to different estate planning needs. Membership costs range from $199 to $599 for a year of access to Will or Trust services. If you want to create a trust, living will, HIPAA authorization, or power of attorney, you’ll need either the Will or Trust plan, as the Guardian plan does not include a will.

When you purchase a plan, you gain access to several features for a full year, including unlimited edits. To continue updating or revising your documents after the first year, you can maintain an annual service at a discounted rate.

Pricing Overview:

-

Will: Essential estate planning documents – $199 for individuals, $299 for couples

-

Trust: Planning documents for assets, children, and healthcare – $499 for individuals, $599 for couples

-

Attorney Support: Access to licensed attorneys in your state – add for $300

-

Probate Support: County-specific estate management assistance – add for $1,999

Trust & Will also offers a 30-day money-back guarantee. For Attorney Support, the service is non-refundable after seven days or once you’ve had your first consultation with an attorney.

Customer Feedback and Ratings

Trust & Will has earned a strong reputation among users. On Trustpilot, it maintains an “excellent” rating, with about 97% of over 3,700 reviews being four- or five-star. Users often praise the platform’s ease of use and clear guidance, noting that the process is more straightforward than many competitors. Negative reviews are rare, and the company typically responds to any concerns within 24 hours.

The Better Business Bureau (BBB) profile is smaller, with only two reviews, but the company holds an A+ rating, reflecting transparency, reliability, and strong business practices.

Frequently Asked Questions (FAQs)

1. What information do I need to create a trust?

To set up a trust with Trust & Will, you will need:

-

A name for your trust

-

Basic information about yourself, your family, and pets

-

The designated guardian for children and pets

-

A Successor Trustee to manage the trust and distribute assets

-

Names of beneficiaries, which can include family, friends, or charities

-

Preferences for final arrangements

-

Asset details to help your Successor Trustee manage distributions (optional)

2. Can I update my documents?

Yes. Trust & Will offers free, unlimited updates for one year. After the first year, updates are available for a nominal fee of $19–$39.

3. Is Trust & Will legitimate?

Despite being a relatively new company, Trust & Will is widely recognized for its user-friendly platform. While trust services may be slightly higher in cost than competitors, the platform provides comprehensive features including attorney access, multiple document types, and educational resources. It is accredited by the BBB with an A+ rating and has excellent reviews on Trustpilot. Support is available seven days a week via live chat.

4. Who is Trust & Will best suited for?

Traditional attorney fees for creating trusts can be expensive. Trust & Will offers an affordable alternative for those looking to draft legally binding estate documents. It is particularly well-suited for:

-

Homeowners with modest personal possessions and retirement assets

-

Individuals or couples planning standard estates

-

Those who want to designate guardians for pets

However, the platform may not fully meet the needs of families with special needs dependents or highly complex estate situations.

5. How secure is Trust & Will?

Trust & Will uses bank-level encryption to protect your data. The company promises never to share or sell your personal information without your consent.

Our Experience Using Trust & Will

When testing Trust & Will, we created a personalized will in approximately 30 minutes. Having all asset information ready—such as real estate, financial accounts, vehicles, and business interests—helps streamline the process. The platform is intuitive, and the instructions guide you step-by-step to ensure your estate plan is complete and accurate.

Conclusion

Trust & Will is a strong option for those seeking fast, affordable estate planning for simple estates. The platform provides state-specific, professionally-informed documents, responsive chat support, and optional attorney assistance. While it may not be ideal for highly complex situations, it remains a reliable choice for straightforward estate planning at a reasonable cost.

Real Customer Reviews

-

Mark V., St. Charles, MO – “Before purchasing, I asked about designating a trustee. They said it was possible, but the platform didn’t allow it. While I was refunded, I wasted hours entering data. Good for basic entry if you can follow the programmed steps.”

-

Mary S., Spring Branch, TX – “My husband and I wanted a simple will. The process seemed easy, but at the end, only my documents were downloadable. There was no way to access his portion of the will or Health Care Directives, even though we completed the process for both of us.”

-

Eileen D., Wasilla, AK – “I started using the platform to create a trust but decided a will was enough. I couldn’t switch back; the system kept me on the trust. Chat support never connected me to a real person.”

-

Paul M., Salmon, ID – “Chat representatives change every time and are often unfamiliar with the software. Some glitches weren’t resolved, and specific gifts weren’t accurately reflected in summaries. Responses felt unprofessional at times.”

Better Finance Info – Personal Finance & Investing Tips

Better Finance Info – Personal Finance & Investing Tips